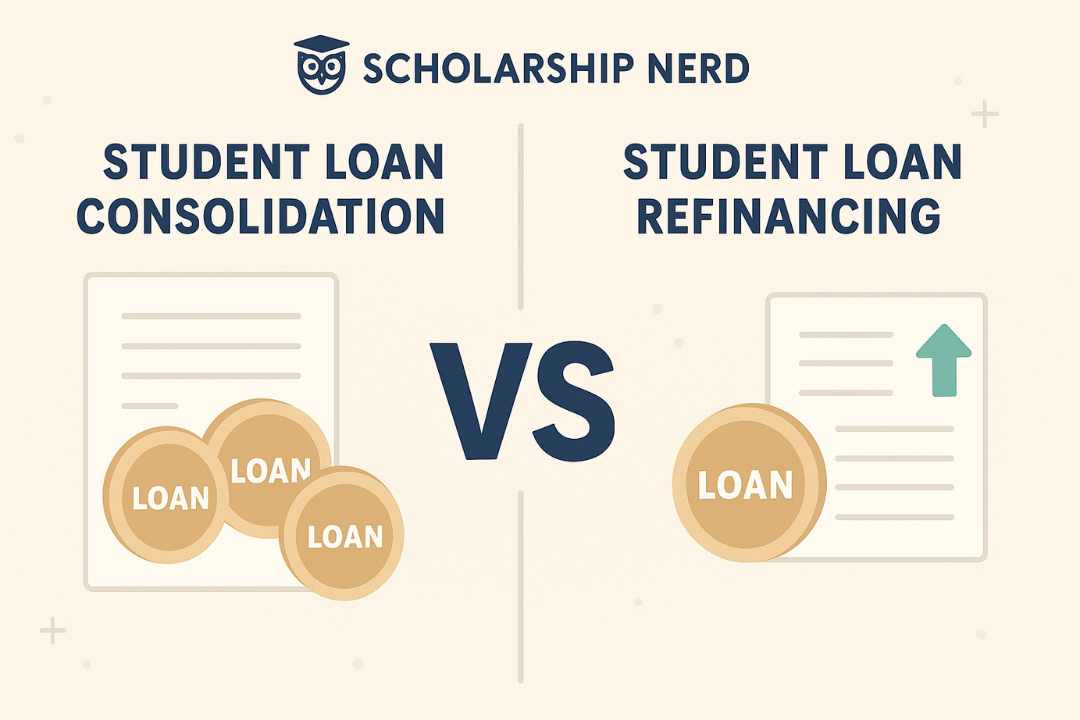

Student Loan Consolidation vs Refinancing: What’s the Difference?

If you’ve ever searched for help managing student debt, you’ve likely seen the terms consolidation and refinancing used almost interchangeably. But while they sound similar, they serve very different purposes.

TL;DR:

- Consolidation = Combine federal loans into one payment (for simplicity)

- Refinancing = Replace any loan (federal or private) with a new one, often at a different rate

This guide breaks down each option, helps you compare them side-by-side, and gives you clarity on which might make sense for your situation.

Understanding Student Loan Consolidation

When you consolidate student loans, you’re merging multiple federal loans into a single new federal loan through the Department of Education’s Direct Consolidation Loan program.

How It Works

- You apply directly through Federal Student Aid (studentaid.gov), not through a private lender.

- Your new loan’s interest rate is the weighted average of your previous loans, rounded up to the nearest one-eighth of a percent.

- There are no application fees and no credit checks.

Why Students Consolidate

- Simplifies multiple payments into one monthly bill.

- Can help regain eligibility for income-driven repayment (IDR) or Public Service Loan Forgiveness (PSLF) if loans were previously ineligible.

- Allows you to select a new servicer or repayment plan.

What It Doesn’t Do

- Does not lower your interest rate.

- Does not include private loans.

- May reset your forgiveness timeline if you’ve already been making qualifying PSLF payments.

Tip: Always verify terms with the Department of Education before applying.

Understanding Student Loan Refinancing

Refinancing is completely different and typically offered by private lenders (not the federal government).

How It Works

- You take out a new private loan to pay off one or more existing federal or private loans.

- Your new rate depends on your credit score, income, and financial history.

- You can often choose between fixed or variable interest rates.

When Refinancing May Help

- You have strong credit or a reliable co-signer.

- Your private loans carry high interest rates.

- You don’t plan to use federal protections such as PSLF or IDR plans.

When to Think Twice

- Refinancing permanently removes federal benefits like deferment, forbearance, and forgiveness options.

- You’ll be working with a private lender, so repayment terms and protections vary.

According to the Consumer Financial Protection Bureau (CFPB), refinancing can reduce your interest costs but can also eliminate valuable safety nets. Make sure you compare before you commit.

Consolidation vs Refinancing: Quick Comparison Table

How to Decide Which Option Is Right for You

Here’s a simple framework:

- If all your loans are federal: Start by considering consolidation. It keeps your access to income-driven repayment and forgiveness.

- If you have high-interest private loans: Explore refinancing to potentially lower your rate.

- If you rely on federal benefits (like PSLF): Avoid refinancing; it’ll make those benefits unavailable.

- If you want simpler payments but stable terms: Consolidation is the safer route.

Rule of thumb: Consolidate for simplicity, refinance for savings, but don’t trade flexibility for a slightly lower rate if you might need federal protections later.

Learn more about how to consolidate or refinance your loans with this detailed guide!

Common Questions About Consolidation and Refinancing

Does consolidating loans affect my credit score?

Not significantly. Federal consolidation doesn’t require a credit check, so it generally won’t hurt your score.

Do I lose forgiveness eligibility if I refinance?

Yes. Refinancing with a private lender removes your eligibility for programs like PSLF or Teacher Loan Forgiveness.

Can I consolidate and refinance?

Technically yes. You could consolidate federal loans first, then refinance all loans later with a private lender. Just know you’ll lose federal protections once you refinance.

When should I consolidate or refinance?

- Consolidate soon after graduation if juggling multiple servicers.

- Refinance when your credit and income improve and you’re no longer depending on federal aid.

Final Thoughts: Simplifying Student Loan Decisions

Managing student debt doesn’t have to feel like a puzzle. Remember: Consolidation simplifies; refinancing optimizes.

Before making changes, always review the official information on studentaid.gov and compare options using the CFPB’s refinance guide.